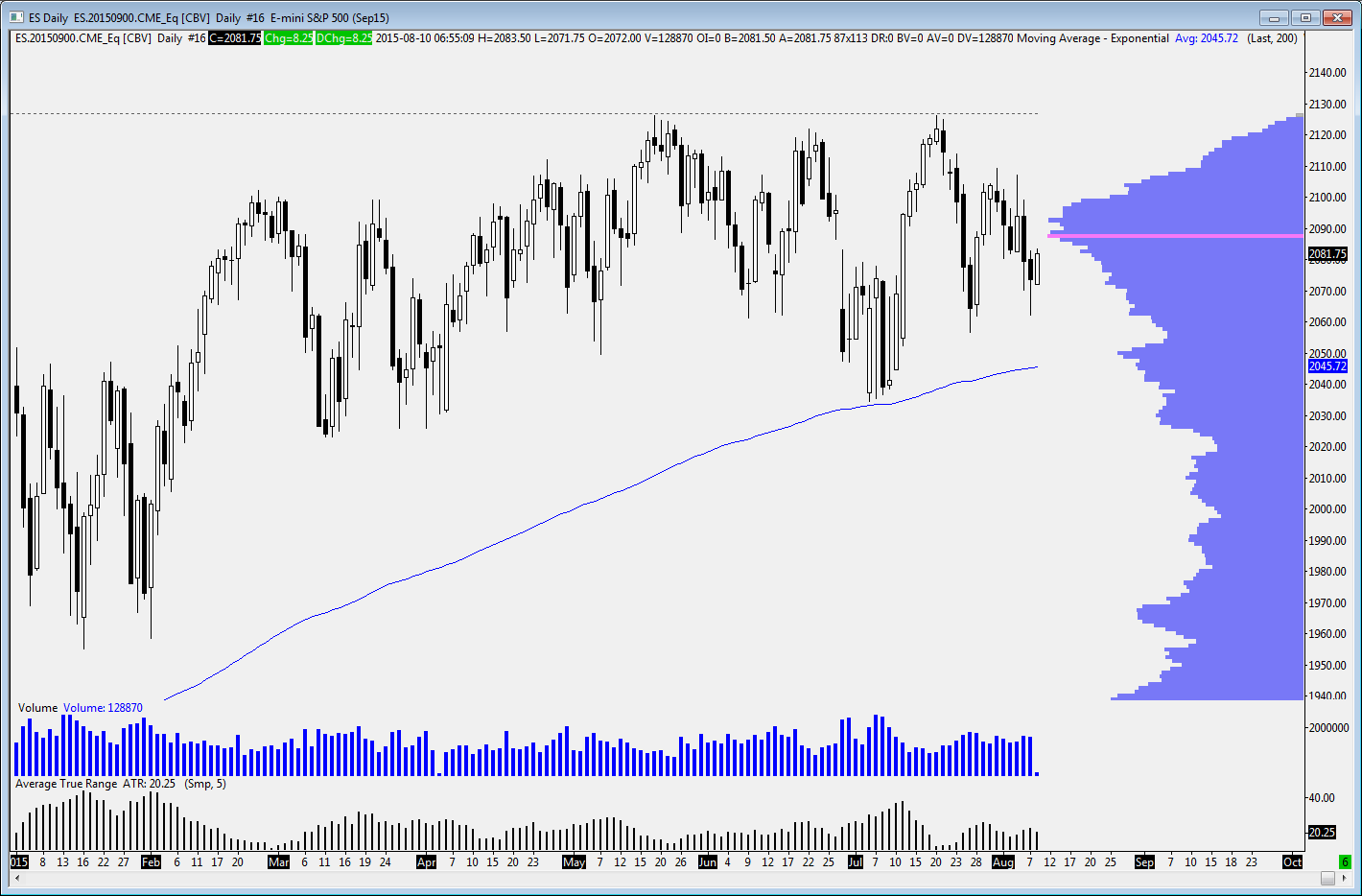

Having missed the last few weeks trading, it appears not a great deal has changed. The market is still within the range of the past 6 months and moving this morning back towards the highest traded price at 2088.00.

Friday saw value overlap lower but it closed above the day's value. There was a test of the prior VPOC after the open and this was rejected and there was a push lower to test support at the 2062.25 VPOC from 27th July

Overnight has drifted higher with the range currently 2071.75-2088.50, with the Fed's Fischer making some dovish comments and Lockhart also due to make some comments. There are no major eco announcements The composite VPOC at 2088.00 is currently where the market is trading . My main expectation is for a balanced, rotational day with a push up into Thursday's single prints and an attempt to close the gap from Friday. The lack of news and the location of the market relative to the composite volume profile means we could see a choppy day. I'm not looking to trade the middle of this area.

Sell Zones: 2097.50-99.25, 2102.00-04.00, 2107.00-09.00

Buy Zones: 2074.75-76.75, 2079.75-82.50