It’s been a long break since my last post and markets have been giving traders some phenomenal opportunities if prepared and able to take on the elevated volatility; it’s certainly not for everyone. As the game evolves, so do the rules of play.

I’m not going to get into the fundamentals in this post as the main aim of the note is provide a technical framework and objective overview of the short term structure, as it relates to intra-day futures trading. However, I will include a more macro fundamental perspective as a weekly note in future for those who are interested.

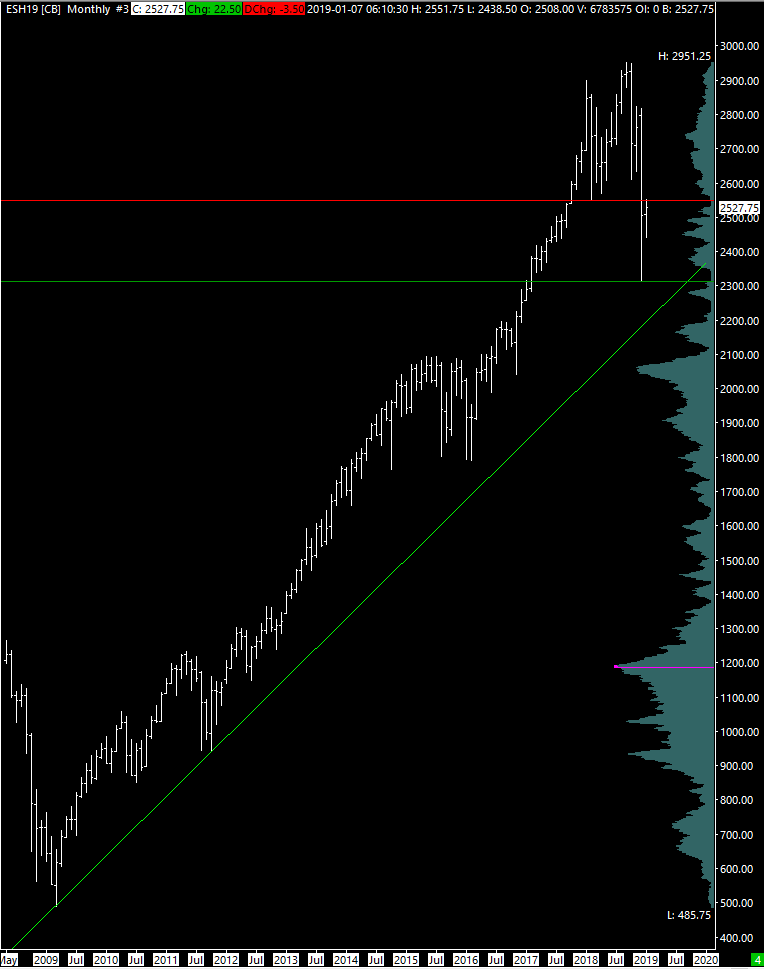

Above we have the monthly, weekly and daily charts for a long term perspective. The counter-rally we’re currently seeing against the monthly downtrend (within a multi year uptrend) is running up against a key area from last year i.e. the Feb lows. You can see an area of low volume (highlighted on daily chart) which could attract longer term sellers. However, short term, both sides will be active and buying was strong on Friday on the latest narrative led move.

Overnight began with a strong rally higher which reversed off the Feb ‘18 low area and moved back down a tick above the Dec 28 swing high. The range is currently 2523.25-51.75 vs settlement at 2531.25

Momentum and market breadth will need to be strong to continue the rally i.e. positive TICK, A/D and cumulative delta.

Overnight support zones at 2527.00-28.25 & 2520.50-23.50. Holding below the overnight low could see a revisit to Friday’s single print area or lower. However, would expect to see a buying response at the 2499-2501 zone on first test.

Overnight resistance zones at 2537.00-41.75 & 49.00-52.50.

Zones for today below: