ES review & plan

The main expectation yesterday was for a push into last Thursday's single prints and for rotation lower to attempt to fill the gap. Despite the low volume and confidence rally yesterday, we didn't see the move lower. The VPOC at 2098.00 was also the regular trading hours high from Thursday 6th Aug.

There was cumulative delta negative divergence yesterday as the market pushed towards it's highs at 2100.75, the cumulative delta was heading towards a low of -12,000. This proved a false flag for short trades up at the sell zone.

Volume was just 1.1m contracts and NYSE volume was 3.5bn shares after the 26 point rally, settling at 2099.75, above my initial sell zone of 97.50-99.25.

The main economic news overnight is a 1.9% depreciation of the Yuan daily reference rate by China (biggest in two decades), and a weaker than expected ZEW survey in Germany.

The range currently is 2085.50-2101.75, down 0.6%. The weak ZEW survey has the Dax down 1.5%, which is dragging on the ES. US productivity and costs are due at 7.30am ct. I'm keeping the zones as they were for today.

ES review & plan

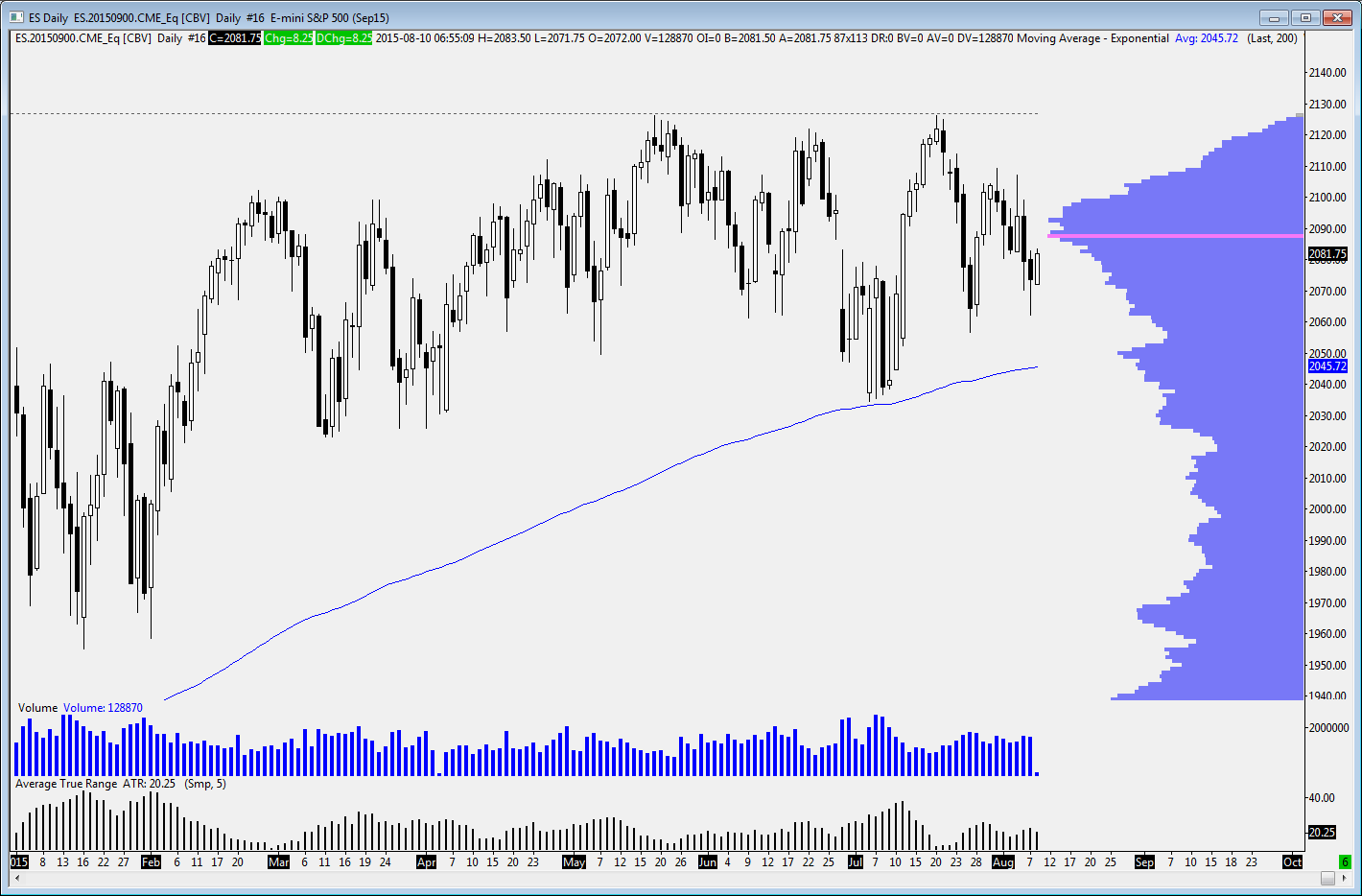

Having missed the last few weeks trading, it appears not a great deal has changed. The market is still within the range of the past 6 months and moving this morning back towards the highest traded price at 2088.00.

Friday saw value overlap lower but it closed above the day's value. There was a test of the prior VPOC after the open and this was rejected and there was a push lower to test support at the 2062.25 VPOC from 27th July

Overnight has drifted higher with the range currently 2071.75-2088.50, with the Fed's Fischer making some dovish comments and Lockhart also due to make some comments. There are no major eco announcements The composite VPOC at 2088.00 is currently where the market is trading . My main expectation is for a balanced, rotational day with a push up into Thursday's single prints and an attempt to close the gap from Friday. The lack of news and the location of the market relative to the composite volume profile means we could see a choppy day. I'm not looking to trade the middle of this area.

Sell Zones: 2097.50-99.25, 2102.00-04.00, 2107.00-09.00

Buy Zones: 2074.75-76.75, 2079.75-82.50

ES review & plan

Yesterday opened fairly strong after a steady rise overnight. The push above the overnight high and move into the single prints Tuesday was rejected and there were clear signs of heavy selling into the high from the order flow and cumulative delta.

Once the overnight high failed to hold, the shorts major target then became the prior day's settlement, which is what they got by the close. Volume was 1.98m contracts and 3.45bn shares traded on NYSE, lower than the prior few days.

Overnight has moved higher with the range 2044.75-68.50 currently, versus settlement at 2041.25. Greece has delivered it's latest offer which has pushed the Dax 2% higher and pulled ES up with it, with EURUSD rallying 150 pips. Bonds are 4 points off the week's high. Janet Yellen is speaking at 11.30 ct.

I haven't changed the zones from yesterday, as seen below. The responsive activity can be seen highlighted. Inside that range continues to be rotational moves but a break of either of those zones could see some initiative activity to drive things.

ES review & plan

ES volume remained high yesterday at 2.4m contracts. The open saw a brief push higher which failed and the session had a heavy controlled feel to it, with larger players getting involved this week it appears. The prior range wasn't broken and the VPOC shifted towards the low at the end of the session a tick below settlement.

Overnight has seen a bounce with the range 2039.75-63.00 currently. We are still trading in the middle of the range and the updated zones are below with potential reactions. If support fails on a test of the 2038.25-40.00 zone, we could a more aggressive press lower to test the 2022.75 swing low from March 11th and low volume zone at 2019.25-20.75.

ES review & plan

Volatility returned yesterday to see a 40 point drop form a V- reversal and rally 40 points. The latter part of the session was split by a spike of single prints between 2064.25-68.25, which will be an important area to watch today for acceptance/rejection. Volume was high at 2.5m contracts and 4.5bn shares traded on NYSE.

Overnight has seen markets begin to take notice of the bubble bursting in China while awaiting the next Greek headline. The ES range overnight is 2042.25-74.75 on above average volume, versus settlement at 2073.75. The FOMC minutes are released at 1pm ct.

Zones for today:

ES review & plan

A huge turnaround from the large gap lower on Sunday night saw prices hold last week's value area. Volume was 1.8m contracts and 3.5bn shares traded on NYSE.

The range continues to hold, as seen on the daily chart below. Prices are gravitating back towards the high volume 2088.00 level.

Zones for today:

Greferendum

Last week's profile shows a fairly balanced week, with concentration in the 2064-69 area. With news on the wires now regarding a likely 'no' vote on the Greek referendum, we will see some big volatility this week and a big sell-off tonight/tomorrow at least, and a move away from last week's range to potentially test the prior range.

The daily chart below highlights the key LVN/HVNs and the bottom of the prior range at 1946.00 if/when it breaks the 2022.75 low of the current range. We are likely to see a large gap lower and the LVNs could be useful fade areas on any bounces. Headline risk is going to be very high with Euro leaders likely to try and put a new deal together and renegotiate with Greece.

ES review & plan

Yesterday the market continued to fill in the anomalies in the profile left from Monday's down day. It was a balanced session which had a very wide overnight range which wasn't breached. Volume was 1.5m contracts and 3.7bn shares traded on NYSE. The charts below show the development of the range this week.

Overnight so far has ranged between 2067.75-76.25 versus settlement at 2071.00. With US markets closed tomorrow, the Employment Report has been brought forward to today at 07.30ct at the same time as Jobless Claims. ECB minutes are due at 06.30ct.

If the market continues to hold above value I'm looking for long opportunities using the zones below with a potential rally to close the gap and towards the composite high volume area. If there are signs of rejection of higher prices I'm looking to fade a move accordingly back into value.

ES review & plan

Apologies to subscribers for missing the last couple of days due to family matters. Did I miss anything?!

The big move down on Monday left many anomalies in the profile which are gradually being repaired. NYSE volume yesterday was a more respectable 4bn shares (compared to Monday's only 3.6bn on the down move). Monday's lack of underlying share volume shows a lack of participation and panic just yet. ES volume has been elevated at 2.28m contracts on Monday and 2.35m yesterday, with greatest concentration within yesterday's value area 2051.75-59.50, with the VPOC at 2054.00.

The low left yesterday wasn't a good end to the downside auction when combined with Monday's. We may see this revisited before the week is out.

Overnight has been moved higher as Greek PM Tsipiras has apparently virtually capitulated to the Eurozone's requests - we shall see. Trapped shorts if there is a (temporary) resolution will potentially fuel a covering rally back into the open gap above.

The Globex range is currently 2054.50-77.50. The main US data today is the ADP employment at 07.30ct and the ISM Manufacturing and PMI manufacturing index at 09.00ct

Zones below for today. The overnight move away from the upper value area of the past few days shows targets and anticipated reactions. If there is failure up here and a move back into value, then will be expected a test of the VPOC and potentially the overnight low and value area low. As has been the case recently, we're in the lap of the Greek gods, so expecting anything to happen.

ES review & plan

We saw value overlap lower yesterday after a lack of agreement between Greece and it's creditors. The saga continues but is approaching an endgame. Participation was light (though much higher than the prior day) despite the news, with volume 1.2m contracts and 3.2bn shares on NYSE. Light volume has now become average volume for the summer.

The initial balance high was 1 ticked and failed, and weak longs bailed to encourage shorts to push through the weak low at 2097 and towards the naked VPOC at 2091.50 pointed out yesterday. There was no continuation to the downside action as shorts appeared to cover back up to the initial balance low and then formed a lower balance distribution.

I'm moving yesterday's bull/bear zone down from 2108.50 to 2097.00-99.50.

We're not expected to hear anything further of substance on Greece until the weekend so we may just see two-sided traded today with a late day positioning move. Overnight the range has been 2090.50-2095.25 on very low volume so far. (2090.50 is the 127.2% fib retracement of the 06/19-06/22 swing move). Consumer sentiment is due at 9am ct.

I'm expecting a test of the bull/bear zone initially and if the market failure to break through it would put the 2082.00-83.25 zone in the sights. If the market does break and hold the 2097.00-99.50 zone, I'm expecting a move to 2106.00-08.00 with potential to 2111.50-12.75. Going into the close ahead of this weekends talks I would expect to see a move back to the composite high volume area.